Operations

Focused Operations & Scaled Asset Portfolio

Our long-life, balanced portfolio combines stable cash flows from low-decline production with a deep, high-quality development inventory.

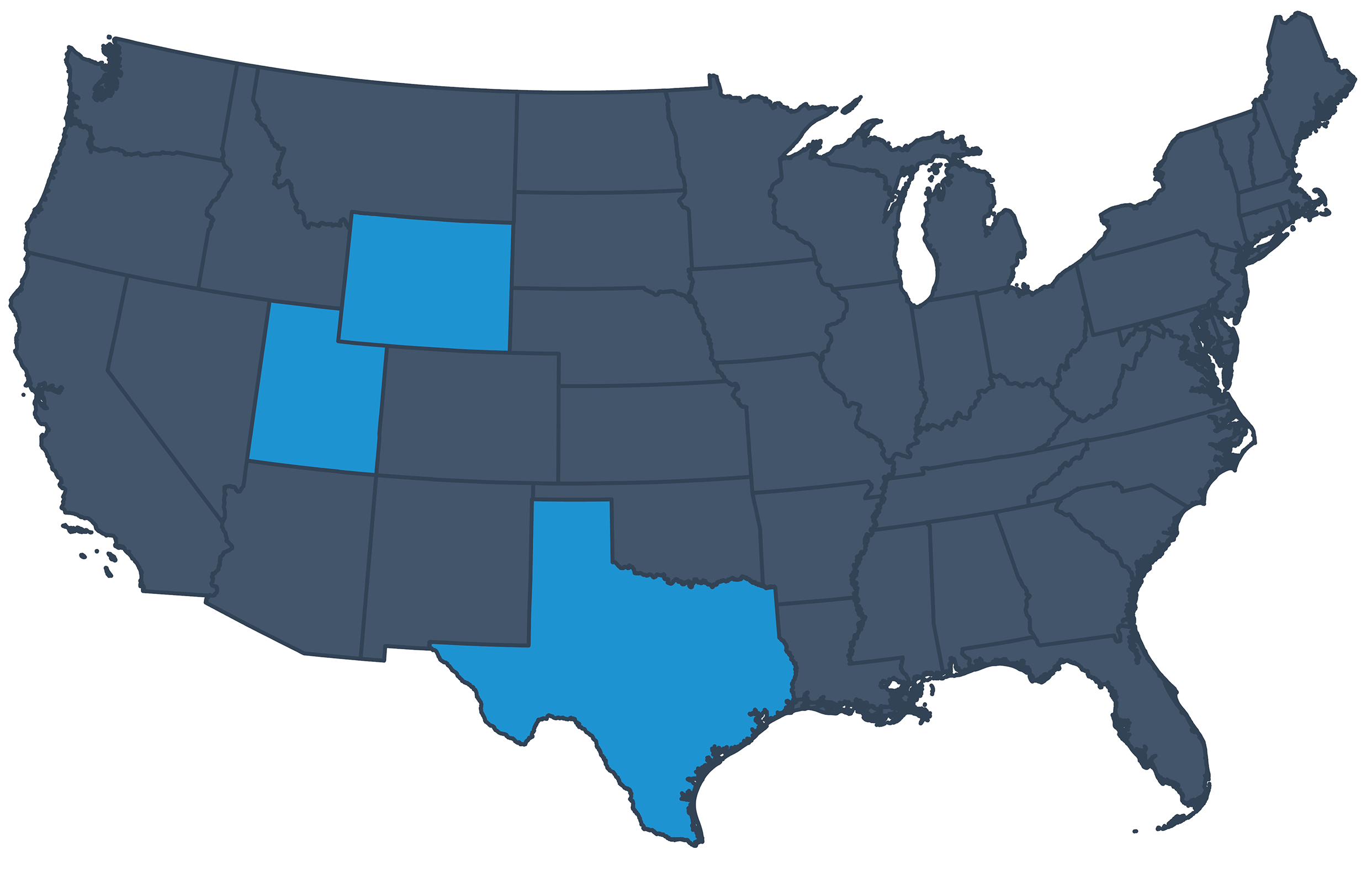

Our operations are focused in Texas and the Rockies with active development in the Eagle Ford and Uinta basins. We also operate conventional assets in Wyoming where we are active in carbon capture, use and storage (“CCUS”). Crescent is a top three producer (by gross operated production) in the Eagle Ford basin:

~256

Mboe/d

2025E Net

Production

~793

MMboe

YE’24 Proved

Reserves

~25%

YE’24 Annual

PDP Decline

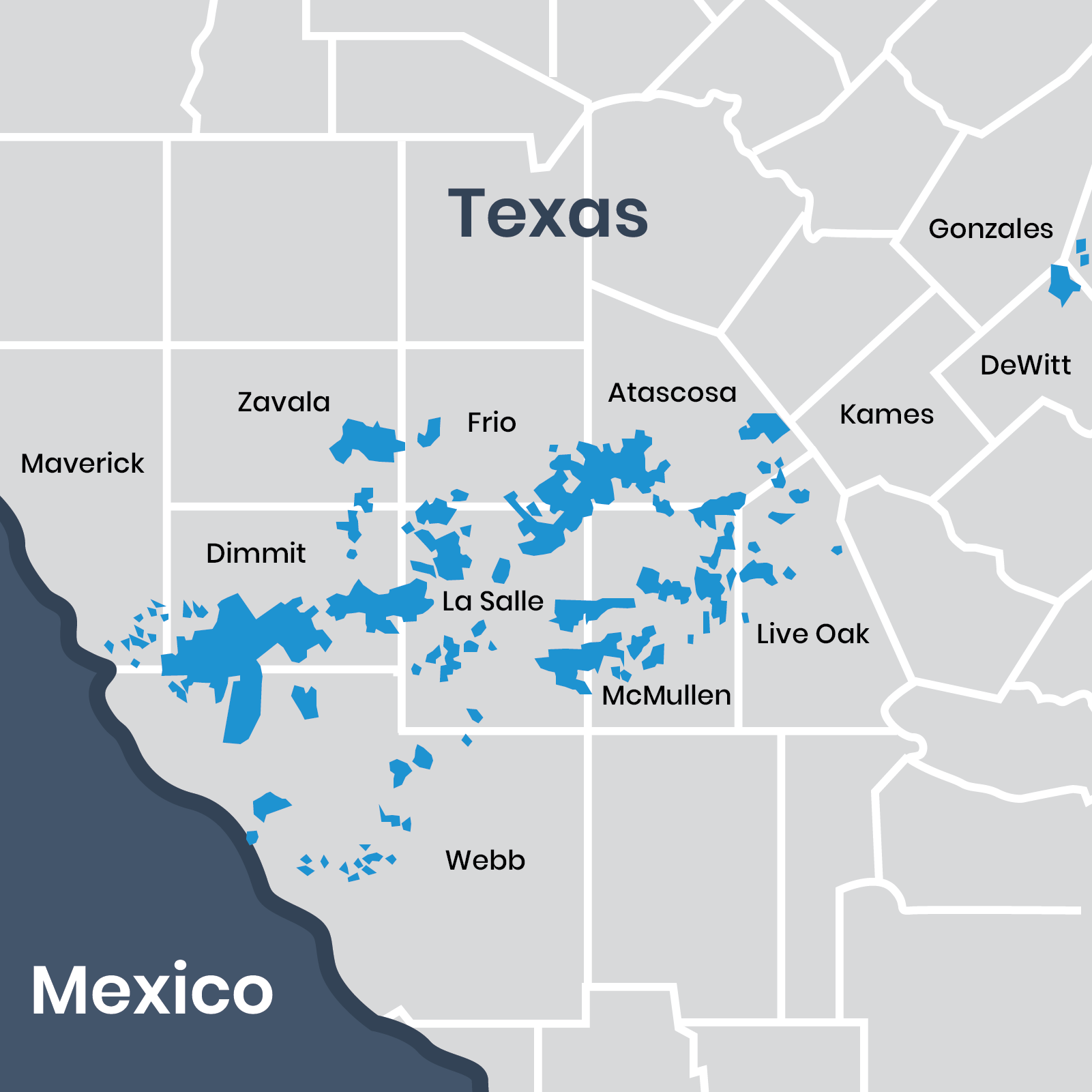

TEXAS

Eagle Ford

Crescent is a long-standing operator in the Eagle Ford with a proven ability to scale and safely capture operational upside. The Eagle Ford basin complements our strategy with stable production, low-risk development inventory and meaningful potential for resource expansion with further growth through acquisition opportunities. Crescent operates in both the oil and condensate windows of the Eagle Ford.

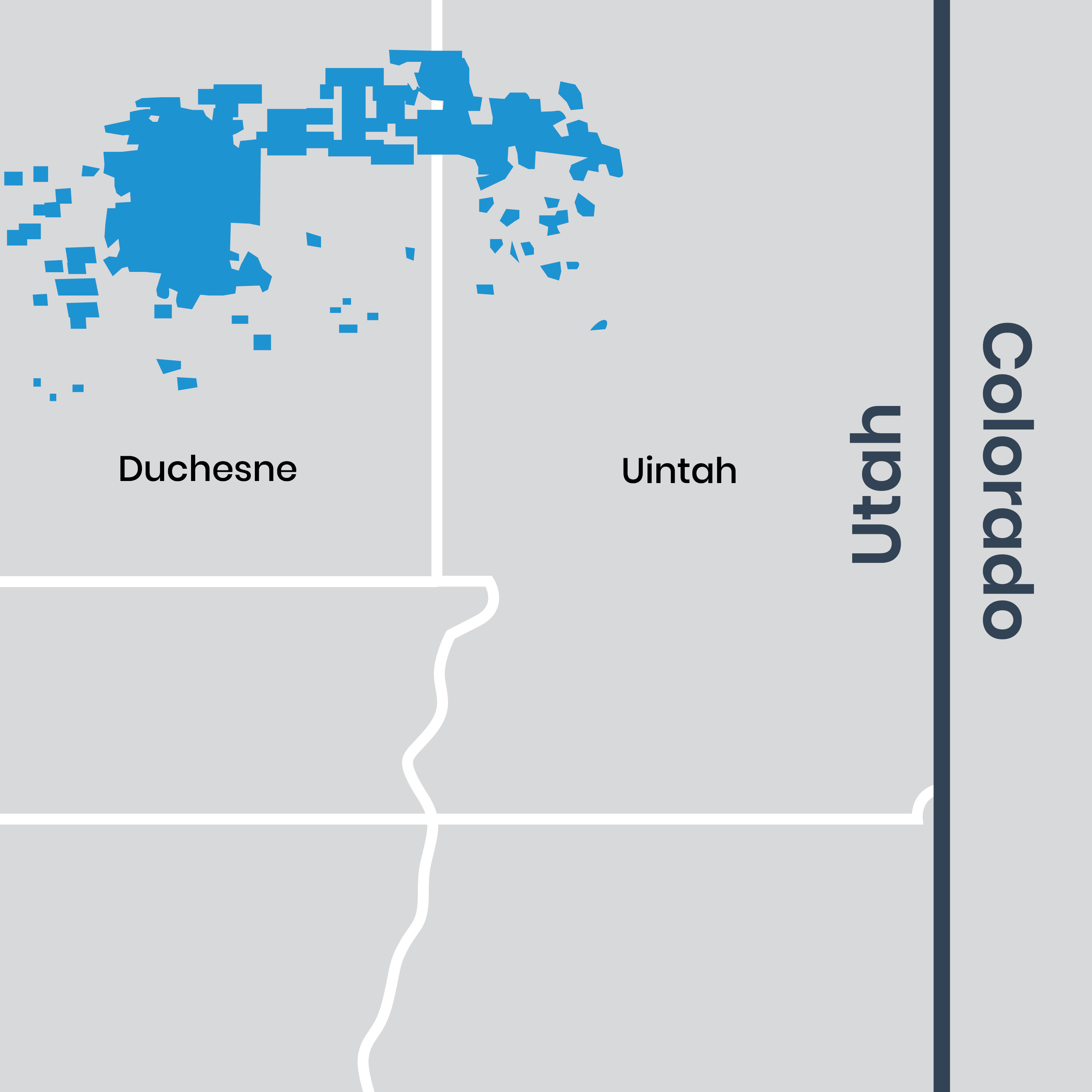

Rockies

Uinta

Crescent’s Uinta position has a large inventory of attractive, low-risk undeveloped locations with significant resource potential across multiple, prolific formations. The Uinta basin produces high-value crude, and we have secured takeaway capacity into the Salt Lake City refining complex.

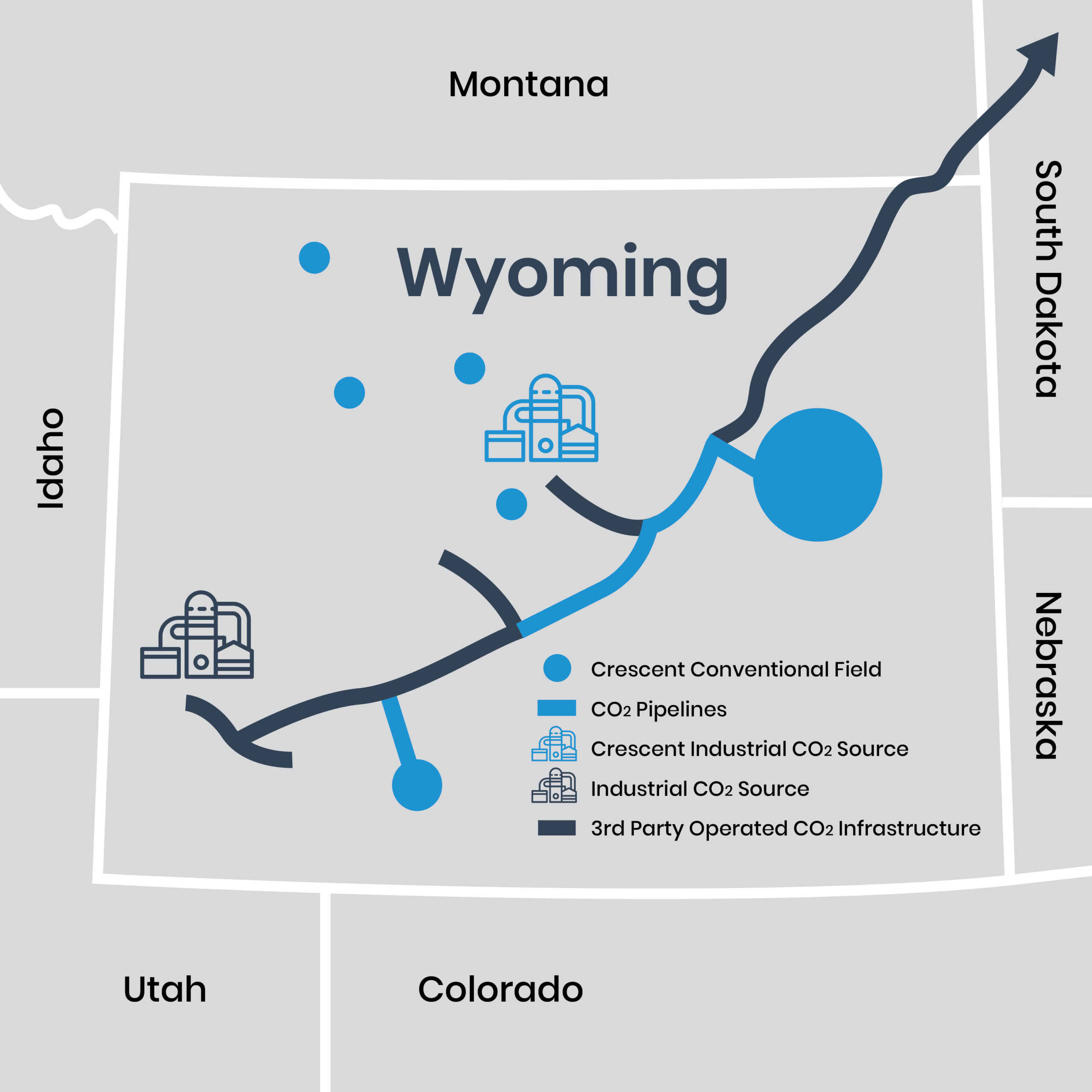

Rockies

Wyoming Conventional

Crescent’s Wyoming operations comprise low-decline conventional production spanning numerous conventional fields. We operate two enhanced oil recovery projects (“EOR”) in Wyoming where we are employing carbon capture, use and storage (“CCUS”). Crescent sees significant upside in organically expanding our EOR and CCUS operations in the region.

10%

10%Texas and Rockies

Minerals

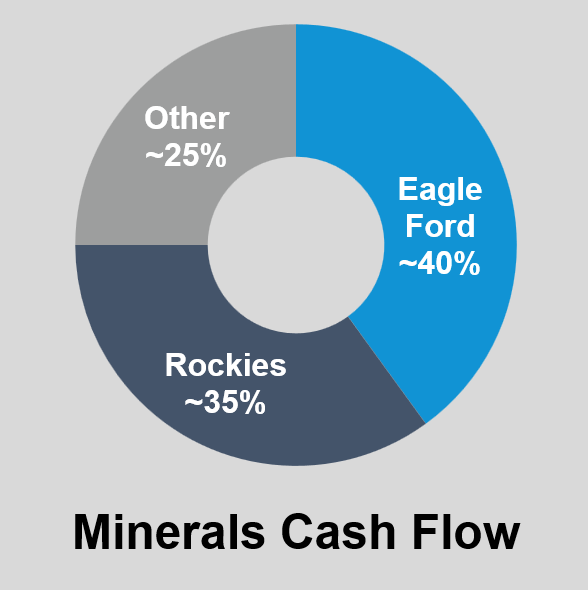

Crescent’s minerals portfolio is focused in Texas and the Rockies with exposure to best-in-class operators. Our existing footprint provides substantial free cash flow, exposure to organic growth without capital costs and significant undeveloped upside.